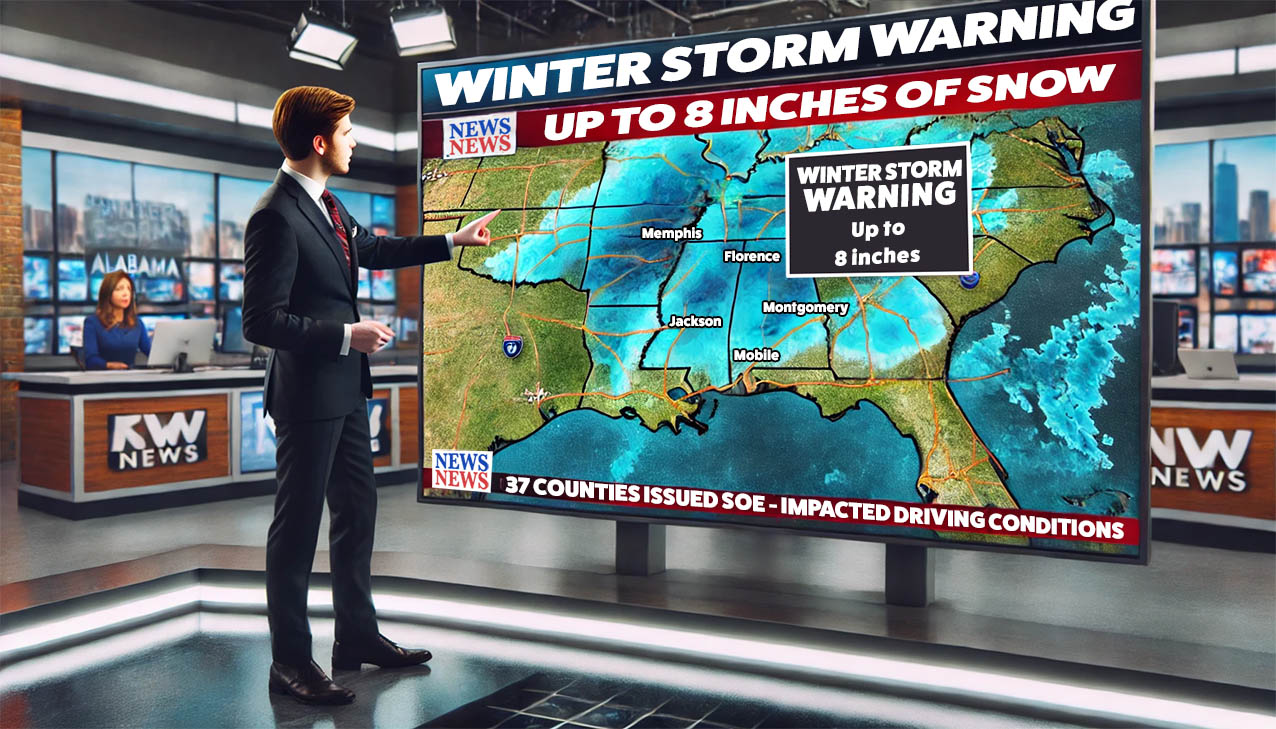

State of Emergency: Winter Weather

On January 9th, 2025, Kay Ivey, the Governor of Alabama, issued a State of Emergency for more than half of Alabama’s 67 counties in preparation for the most recent winter storm. Before the storm, Governor Ivey stated, “Cold temperatures have persisted in Alabama this week, and we are anticipating the potential for winter weather to impact our state, particularly our driving conditions.” She further warned, “…if you are in an impacted area and do not have to be on the road, try to avoid it.” This warning seems sound, but what happens if you decide to go out anyway and are accidentally involved in a car wreck?

Let’s face it— auto insurance companies are a for-profit business, and it’s a forced requirement if we plan to operate a motorized vehicle (not bringing up bonds, cash, and securities alternatives). And it’s a very, very BIG business. Every business is looking for ways to save money. So, it’s important to read your policy carefully (even if it’s 500+ pages with 5pt type) to ensure your insurance company won’t find a reason “loophole” to deny or partially deny your claim. If you don’t have time to read your policy in detail or don’t understand certain sections, call your auto insurance company and ask them to explain your policy, specifically if there are any exclusions or restrictions for driving during a state of emergency with road closures. Every policy is different, and it’s okay to seek clarification. Document your phone call, including the representative’s name and the clarification they provided. Then, you can better decide whether going out in a snowstorm is worth the risk. Regardless, if you can stay home— stay home! Your safety is never worth the risk.